Getting paid on time is a fundamental right for workers. When an employer delays a paycheck or fails to pay final wages after you leave a job, the consequences can be serious, like unpaid bills, overdraft fees, and stress. Oregon law requires employers to pay wages on a regular schedule and imposes strict deadlines for final paychecks.If your employer isn’t paying you on time, understanding these rules can help you take action and recover what you’re owed.

In this guide, we break down Oregon’s paycheck laws, explain when employers must issue final pay, and describe the penalties for late payment. We also cover what to do if you are underpaid and how Meyer Employment Lawcan help you file a wage claim. It also discusses wage theft claims, overtime violations, misclassification, and steps employees can take to recover unpaid wages.

Read More:

Oregon Employment Wage Claims

Oregon Employment Wage Claims: Employee Rights to Collect Unpaid Wages

Employee Rights to Meal and Rest Breaks in Oregon

How to Handle Unfair Treatment at Work

Regular Paydays and Pay Intervals

Oregon law requires every employer to establish and maintain a regular payday. The payday must be on a set schedule that is no more than 35 days apart. Employees must be paid all wages due and owing on that payday. The law allows employers to pay at more frequent intervals (for example, weekly or bi‑weekly), but they cannot delay pay for more than 35 days.

What happens if you’re underpaid?

If an employer discovers that an employee was underpaid on a regular payday and there is no dispute about the amount owed, the employer must correct the mistake quickly. Oregon law distinguishes between small and significant underpayments:

- Underpayment under 5 %:If the underpayment is less than five percent of the employee’s gross wages, the employer must pay the balance no later than the next regular payday.

- Underpayment 5 % or more:If the underpayment is five percent or more of the employee’s gross wages, the employer must pay the unpaid amount within three daysafter learning of the underpayment, excluding weekends and holidays.

This means that employees do not have to wait weeks or months for corrections. Once the employer knows a paycheck was short, they are obligated to pay promptly.

Employers can’t delay paychecks as punishment

Oregon’s Bureau of Labor & Industries (BOLI) emphasizes that employers may not withhold or delay paychecks as a form of discipline or as leverage. Employers also cannot demand the return of company property before issuing a final paycheck. The employer must pay wages when due and then seek reimbursement or return of items separately.

Final Paychecks: What’s Required When You Leave a Job

When your employment ends, different rules apply depending on whether you are fired, laid off, or you resign. ORS 652.140details when final wages become due:

- If you are terminated or laid off(or your employment ends by mutual agreement), all wages earned and unpaid must be paid no later than the end of the first business dayafter termination.

- If you quit with at least 48 hours’ notice(excluding weekends and holidays), your final wages are due immediately on your last day of work. If your last day falls on a weekend or holiday, payment is due the next business day.

- If you quit without at least 48 hours’ notice, your final wages are due within five days(excluding weekends and holidays) or on the next regularly scheduled payday, whichever occurs first.

- If you quit without notice and must submit time records(for example, if you track your own hours), the employer must pay the wages it estimates are due within five days, and then pay any remaining wages within five days after you submit your records.

These rules apply to most employers. Collective bargaining agreements may provide different procedures, and special rules exist for seasonal or fair‑related employment.

Penalty wages for late final pay

If an employer willfully failsto pay wages owed upon termination, Oregon imposes a penalty wage. Under ORS 652.150, the penalty is calculated as follows:

- The employee’s wages or compensation continue to accrue at the same hourly rate for eight hours per dayfrom the date wages were due until they are paid.

- The penalty continues for up to 30 days.

- Employers can limit their liability to 100 % of the unpaid wagesby paying the full amount within 12 days after receiving written noticefrom the employee.

In other words, if you are owed $1,000 and your employer doesn’t pay within the deadline, you may be entitled to an additional amount equal to eight hours of your regular wage for each day until payment is made, up to 30 days. The penalty is intended to discourage employers from delaying final paychecks.

Civil penalties

BOLI’s paycheckspage explains that, in addition to penalty wages payable to the employee, Oregon law authorizes BOLI to impose a civil penaltyof $1,000 plus costs, interest and attorney feesfor willful failure to pay wages at termination. These penalties are paid to the state and can increase the financial consequences for noncompliant employers.

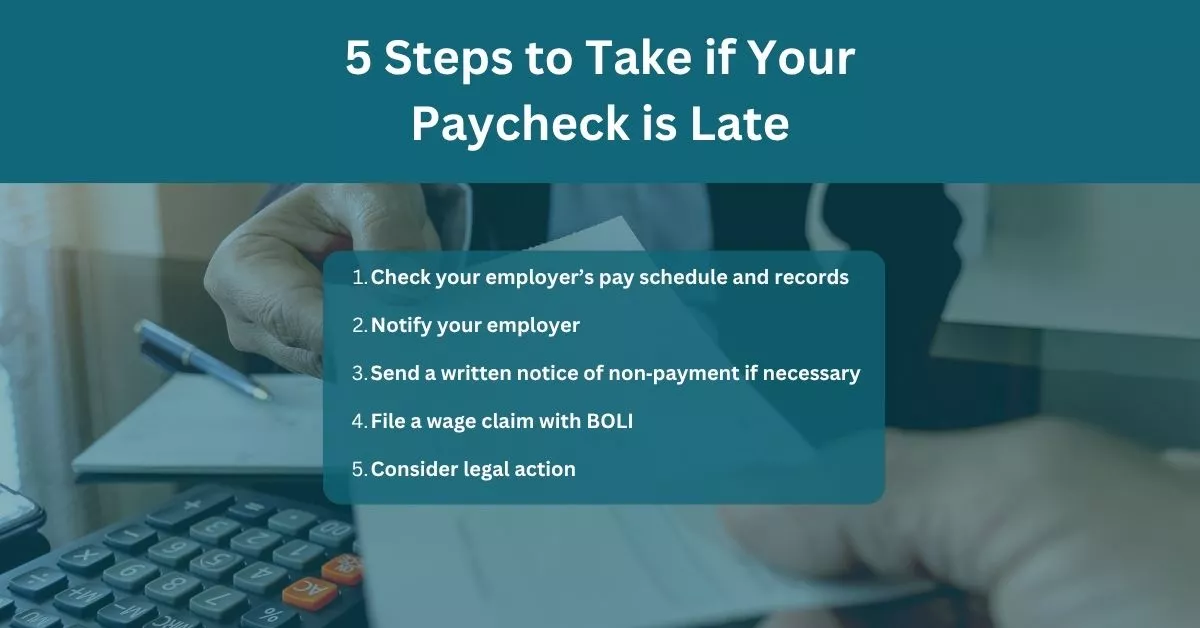

5 Steps to Take if Your Paycheck is Late

If you haven’t been paid on time, take these steps:

1. Check your employer’s pay schedule and records

Review your employer’s pay schedule (often listed in the employee handbook) and confirm the date your wages were due. Keep track of hours worked, overtime, commissions and any deductions. Compare your records with your pay stub or deposit to identify discrepancies.

2. Notify your employer

If you believe you were underpaid or not paid on time, notify your employer in writing. Politely explain the error and provide documentation. In many cases, underpayment is an honest mistake that an employer will quickly correct — especially given the short deadlines set forth in ORS 652.120.

3. Send a written notice of non‑payment if necessary

If your employer fails to pay final wages, send a written notice of non‑payment. Under ORS 652.150, this notice triggers the 12‑day period during which the employer can avoid penalty wages by paying the full amount. The notice should estimate the amount owed or include facts sufficient to determine the amount owed. Keep a copy of the notice for your records.

4. File a wage claim with BOLI

If your employer still doesn’t pay, you can file a wage claim with BOLI’s Civil Rights Division. BOLI’s paycheckspage states that employees who have not been paid can file a wage claim, file a small claims action for amounts under $10,000, or consult an attorney. Filing a claim begins an investigation; BOLI may recover unpaid wages, penalty wages, and civil penalties. The law prohibits employers from retaliating against employees who file a wage claim or assist in an investigation.

5. Consider legal action

You may also sue your employer for unpaid wages and penalties. Oregon law allows employees to recover attorney fees in wage claim lawsuits. If your claim is substantial or complex, consult an employment lawyer. An attorney can help determine whether to file in small claims court or regular court and can negotiate on your behalf.

Additional Rights and Protections

If an employer repeatedly fails to pay wages within five days of a scheduled payday, BOLI may require them to post a bondto ensure future payment. If the employer fails to provide the bond, the commissioner may seek a court order to force compliance or stop the employer from doing business until they comply. This tool protects employees from chronic wage violations.

Discrimination for wage claims is illegal

Oregon law prohibits employers from retaliating or discriminating against employees for filing wage claims or refusing to work more hours than allowed. This protection means you should not be fired, demoted, or penalised for insisting on your right to be paid on time.

Conclusion

Late paychecks and unpaid wages can wreak havoc on your finances and cause unnecessary stress. Fortunately, Oregon has clear laws that require employers to pay wages on a regular schedule, issue final paychecks within strict deadlines and provide penalties when they don’t.

By understanding these rules and documenting any underpayments, you can hold your employer accountable and recover what you’re owed. If your employer isn’t paying you on time or refuses to issue a final paycheck, don’t hesitate to seek legal guidance. Meyer Employment Lawcan help you navigate wage claims, enforce your rights and ensure you receive the compensation you deserve.

FAQs

Can my employer delay my paycheck as punishment?

No. BOLI expressly states that employers may not withhold or delay paychecks as a form of discipline.

Do penalty wages apply if I quit without notice?

Yes. If your final paycheck is late, penalty wages may still accrue. However, penalty wages are limited if you fail to submit a written notice of non‑payment — they cannot exceed 100 % of your unpaid wages.

Are commissions subject to penalty wage rules?

Generally, yes. However, if you work on commission for a business that primarily sells vehicles or farm equipment, commissions may not be due until the conditions of the commission agreement are fulfilled. For disputes about commission amounts, penalty wages may be limited to the unpaid commission or $200, whichever is greater.

What if my employer is financially unable to pay?

Employers may avoid penalty wages by proving financial inability to pay wages at the time they were due. However, they still owe the wages and may be liable once they are able to pay.

How Meyer Employment Law can help

If you haven’t been paid on time or you suspect that your employer is violating Oregon’s wage laws, Meyer Employment Lawcan help. Our firm represents workers throughout Oregon in wage claim disputes. We can:

- Review your pay records and determine if your employer violated ORS 652.120, ORS 652.140 or ORS 652.150.

- Draft and send written notices of non‑payment and negotiate with your employer on your behalf.

- File wage claims with BOLI or lawsuits in court to recover unpaid wages, penalty wages, interest and attorney fees.

- Protect you from retaliation and ensure your rights are upheld throughout the process.

Contact usfor a confidential consultation and learn how we can help you recover the wages you earned.