Tipping is a huge part of the service industry, whether you’re a server in a restaurant, a bartender, a barista, or a salon professional. For many employees in Oregon, tips make up a significant portion of their income. But what happens when business owners or managers try to take a share of those tips? Is it legal for them to keep part of the money customers intended for workers?

The short answer: No, owners and managers generally cannot take tips in Oregon.The law is designed to ensure that tips belong to the employees who earn them. Unfortunately, some employers either misunderstand or ignore these rules, leaving workers short-changed.

This guide will walk you through Oregon’s tipping laws, explain when tip pooling is allowed, highlight common violations, and outline the steps you can take if your employer is taking money that should be yours. And if you need help recovering wages, anOregon employment lawyercan protect your rights and hold employers accountable.

TL;DR

In Oregon, owners and managers cannot take employee tips. Tip pooling among employees is legal, but employers cannot keep tips for themselves or cover business expenses with them. If your tips are being withheld, document everything and contact BOLI or an employment lawyer to recover your wages.

Understanding Oregon’s Tipping Laws

Tipping laws in Oregon combine federal regulations with state-level protections. The Fair Labor Standards Act (FLSA)sets a baseline for tip rules nationwide, but Oregon provides additional worker protections.

Here’s what you need to know:

- Tips are the property of employees.Once a customer leaves a tip, it belongs to the worker who earned it — not the business owner.

- Oregon does not allow a “tip credit.”Some states let employers pay less than minimum wage if employees earn tips, but Oregon requires employers to pay the full state minimum wage on top of tips.

- Employers cannot deduct business expenses from tips.For example, owners cannot use tips to cover credit card processing fees, breakage, or shortages.

These rules make Oregon one of the stronger states for employee wage protections.

Can Owners or Managers Take Tips?

The law is very clear: Owners, managers, and supervisors cannot take tips from employees.This prohibition exists to prevent those in power from skimming money that customers intended for frontline workers.

Under Department of Labor regulations:

- Owners cannot keep tips.Even if the business is struggling financially, owners cannot dip into employee tip pools or retain tips directly.

- Managers and supervisors cannot keep tipsunless they personally and solelyprovide the service that earned the tip. For example, if a bar manager serves a table directly and receives a tip, they may keep it. But they cannot share in pooled tips or take tips from employees.

- Service charges are different.A mandatory “service charge” (such as an automatic 20% added to large parties) is not considered a tip under the law. Businesses may keep service charges unless they clearly state otherwise.

In practice, this means owners and managers are almost never entitled to employee tips.

Tip Pooling in Oregon

Tip pooling — where employees combine their tips to share among staff — is legal in Oregon under certain rules. However, owners and managers cannot participate.

How it works legally:

- Employees like servers, bartenders, bussers, and baristas may be required to pool tips and distribute them fairly.

- Non-tipped employees who directly support service (like kitchen staff) can sometimes be included.

- Owners, managers, and supervisors must be excluded from tip pools.

Transparency is key.Employers must clearly communicate tip pool policies so employees know how tips are distributed. Sneaky deductions or undisclosed “house fees” are illegal.

Common Violations Around Tips

Unfortunately, not every business follows the rules. Some common violations employees report include:

- Owners skimming tipsto cover business expenses or personal profit.

- “House fees” or “service charges”being falsely labeled as tips, then kept by management.

- Managers pressuring employeesto share tips improperly.

- Illegal deductionsfrom pooled tips to cover credit card fees, uniforms, or broken equipment.

These practices are unlawful and can cost employees hundreds or even thousands of dollars each year.

Employee Rights and Remedies

If your employer is taking tips, you have rights. Oregon law provides strong protections for workers in these situations.

- You’re entitled to the full amount of your tips.Employers cannot legally withhold them.

- You’re protected from retaliation.If you complain about tip theft, your employer cannot legally fire you, reduce your hours, or punish you.

- You can file a wage claim.The Bureau of Labor and Industries (BOLI) investigates wage complaints and can help you recover stolen tips.

- You may be entitled to damages.In addition to unpaid tips, employers may be required to pay penalties, interest, and your attorney’s fees.

These remedies are designed to make workers whole and discourage employers from breaking the law.

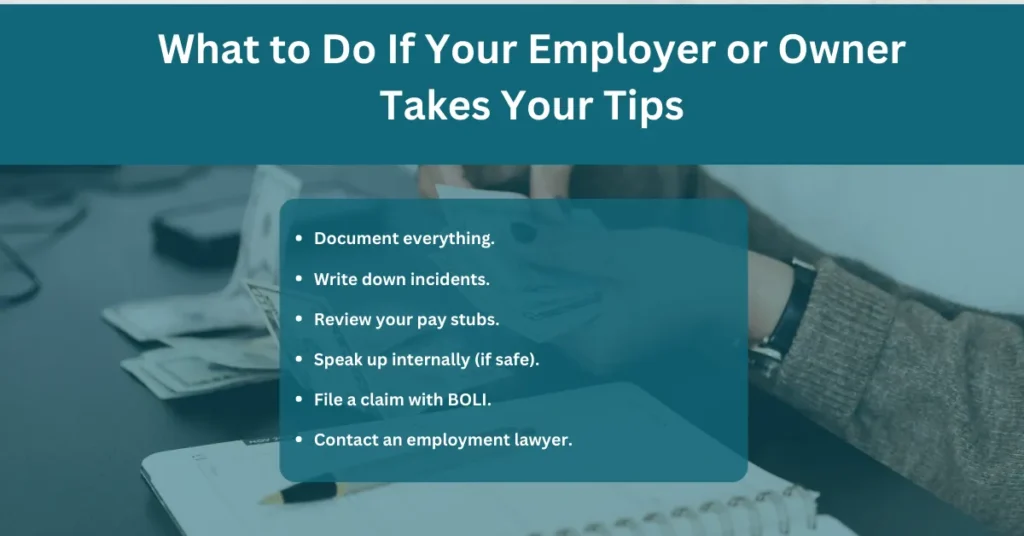

What to Do If Your Employer or Owner Takes Your Tips

If you suspect your employer is mishandling your tips, here are the steps you should take:

- Document everything.Keep track of your tip amounts, receipts, and any records that show what you should have earned.

- Write down incidents.Note the dates and details of when tips were taken or mismanaged.

- Review your pay stubs.Look for discrepancies between reported tips and what you actually received.

- Speak up internally (if safe).Sometimes employers correct errors once confronted.

- File a claim with BOLI.The Bureau of Labor and Industries handles wage theft complaints in Oregon.

- Contact an employment lawyer.An attorney can guide you through filing claims, negotiating with employers, or taking legal action.

The key is to act quickly. Waiting too long may make it harder to prove your case or recover your money.

Why Legal Guidance Matters

Even though the law is clear that owners and managers cannot take tips, disputes often become complicated. Employers may mislabel service charges, create vague tip pool systems, or retaliate against employees who speak up.

A knowledgeable employment lawyer can:

- Explain whether your employer’s practices violate state or federal law.

- Help you file claims with BOLI or the Department of Labor.

- Negotiate with employers to recover unpaid wages.

- Represent you in court if necessary.

Because tip-related disputes often involve multiple employees, having legal support ensures your rights are protected and that employers are held accountable.

Conclusion

In Oregon, tips belong to employees not business owners or managers. While tip pooling may be legal among workers, owners and supervisors cannot take a share of tips. If your employer is skimming tips, mislabeling service charges, or otherwise mishandling your wages, you have the right to speak up and take action.

An experiencedOregon employment lawyercan help you understand your options, file claims, and recover the money you’ve earned. Don’t let your hard work go uncompensated — the law is on your side.

FAQs

Can my restaurant owner take part of my tips?

No. Owners and managers are prohibited from keeping employee tips.

Is tip pooling legal in Oregon?

Yes, but only among employees. Owners and managers cannot be included.

What’s the difference between a service charge and a tip?

A tip is voluntary and belongs to the worker, while a service charge is mandatory and may go to the business.

How do I report stolen tips in Oregon?

You can file a claim with BOLI or work with an employment lawyer to recover unpaid wages.

Can my employer punish me for complaining about tips?

No. Retaliation is illegal under Oregon and federal law.