Misclassification occurs when an employer treats a worker who is actually an employee under the law as an independent contractor. Employers may do this deliberately to avoid paying payroll taxes, workers’ compensation insurance, unemployment insurance and employee benefits. The U.S. Department of Labor (DOL) notes that misclassified employees often lose the minimum wage and overtime pay they are entitled to under the FLSA. In Oregon, misclassified workers may also be denied unemployment insurance, workers’ compensation coverage, family and medical leave and other benefits.

Misclassification lawsuits seek to correct this unfairness by allowing workers to recover unpaid wages and benefits and hold employers accountable in case of this unfairness and/or wrongful termination.

Read More

- Oregon Independent Contractor Laws: What Workers and Businesses Must Know

- Not Getting Paid on Time? Oregon Late Paycheck Laws Explained

- Employee Rights to Meal and Rest Breaks in Oregon

- Oregon Labor & Employment Laws: What You Need to Know

- Overtime Laws in Oregon & How to Calculate Overtime Pay

- Oregon Unpaid Sales Commission Disputes

What Counts as an Employee in Oregon?

Under Oregon law, a true independent contractor must satisfy the criteria in ORS 670.600. This statute requires that the individual be free from direction and control, operate an independently established business and meet specific factors like owning tools, having the right to hire helpers, advertising services to the public and setting the price for the work. If any of these factors are missing, the worker is presumed to be an employee.

Employees are entitled to wage and hour protections, overtime, and other benefits under state and federal law. The distinction matters because misclassified workers can bring claims against their employers for benefits they were denied.

Why Misclassification Matters

Misclassification harms workers and the state. According to Oregon’s Bureau of Labor & Industries (BOLI), misclassified workers may miss out on minimum wage, overtime pay, workers’ compensation, unemployment insurance, sick leave, vacation pay and retirement benefits. They also become responsible for paying both the employer’s and employee’s share of Social Security and Medicare taxes, which can mean thousands of dollars in lost income.

When workers are misclassified, businesses avoid payroll taxes and insurance premiums, shifting costs onto workers and taxpayers. Employers who misclassify may face back wages, civil penalties, interest and lawsuits.

Federal and State Enforcement

The U.S. Department of Labor’s Wage and Hour Division enforces misclassification under the FLSA. The DOL’s 2024 final rule revises the analysis of employee versus independent contractor status and rescinds earlier guidance. The rule emphasizes that misclassified employees may not receive minimum wage and overtime pay or other benefits.

Workers may file complaints with the DOL or state agencies to recover unpaid wages and benefits.

In Oregon, multiple agencies including BOLI, the Employment Department, the Construction Contractors Board, and the Department of Consumer & Business Service, can investigate misclassification.

Oregon’s Business Impacts page notes that misclassified employees are deprived of benefits such as unemployment insurance, workers’ compensation, minimum wage, overtime, sick leave, vacation pay and retirement benefits. Employers who misclassify may owe back pay, civil penalties and interest.

Recognizing Misclassification

How do you know if you’ve been misclassified? Consider these factors:

- Control over your work. If the company dictates how, when and where you perform your job, you are likely an employee. Independent contractors control their own schedule and methods.

- Separate business. Employees usually work only for one employer. Independent contractors run their own businesses, advertise services, invoice clients and may have multiple customers.

- Tools and equipment. Employees typically use the employer’s tools and equipment. Contractors supply their own tools and materials.

- Financial risk and opportunity for profit. Independent contractors have the ability to make a profit or suffer a loss; employees are paid a wage or salary regardless of business performance.

If these factors suggest you are an employee but you’re paid as a contractor (via 1099 rather than W‑2), you may have a misclassification claim. Review your contract and job duties, document communications about work conditions and consult an attorney to evaluate your status.

What Damages Can You Recover?

Misclassified workers can sue for:

- Unpaid minimum wage and overtime. FLSA and Oregon wage laws require employers to pay at least the minimum wage and overtime for hours over 40 per week. Misclassified workers often work overtime without extra pay.

- Reimbursement for expenses. If you were required to pay for equipment, travel or other business expenses that should have been covered by your employer, you can recover those costs.

- Unpaid benefits. You may seek compensation for paid leave, health insurance, pension contributions and other benefits your employer would have provided if you were treated as an employee.

- Statutory penalties and interest. Oregon law allows civil penalties and interest on unpaid wages. In cases of deliberate misclassification, penalties can be substantial.

- Attorneys’ fees and costs. Many employment statutes allow successful plaintiffs to recover attorneys’ fees and litigation costs. This makes lawsuits feasible for workers who otherwise couldn’t afford legal representation.

How to Bring a Misclassification Lawsuit

- File an administrative complaint. In Oregon, you can file a complaint with BOLI’s Wage and Hour Division, which investigates unpaid wages, overtime and misclassification claims. The federal DOL also accepts complaints. Agencies can order employers to pay back wages and benefits.

- Consult an employment lawyer. Misclassification cases involve complex factual and legal issues. A lawyer can evaluate your situation, gather evidence and advise whether to file a lawsuit or pursue administrative remedies. Many employment attorneys offer free consultations.

- File a civil lawsuit. If administrative remedies don’t fully compensate you, you can sue your employer in state or federal court. Claims may include wrongful termination, wage theft, breach of contract, and other violations. In Oregon, misclassification cases are often combined with claims for unpaid overtime, meal and rest break violations, and penalties.

- Consider class actions. If multiple workers have been misclassified by the same employer, a class action or collective action under the FLSA may be appropriate. Class actions can increase bargaining power and result in significant settlements.

Proving Your Claim

To succeed in a misclassification lawsuit, you must show that you should have been treated as an employee. Evidence includes:

- Employment records. Pay stubs, timesheets, emails and communications showing control over your schedule and duties.

- Contracts. The terms of your agreement may show that the company retained the right to control your work.

- Witness testimony. Co‑workers can corroborate that you were treated like an employee.

- Comparison to employees. If the employer treats other workers with similar duties as employees (W‑2), that supports your claim.

The employer may argue that you are an independent contractor because you signed a contract or work part time. However, labels do not determine status: courts look at the actual relationship and degree of control. The DOL emphasizes that misclassification occurs when employers treat employees as contractors to avoid wage laws.

Time Limits for Filing

There are deadlines for filing misclassification claims. Some wage claims must be filed within one year. Federal wage claims typically have a two‑year statute of limitations (three years for willful violations). Other claims, such as those under the Oregon Unlawful Trade Practices Act or for breach of contract, may have different limits. Consult with an attorney to ensure you meet all deadlines.

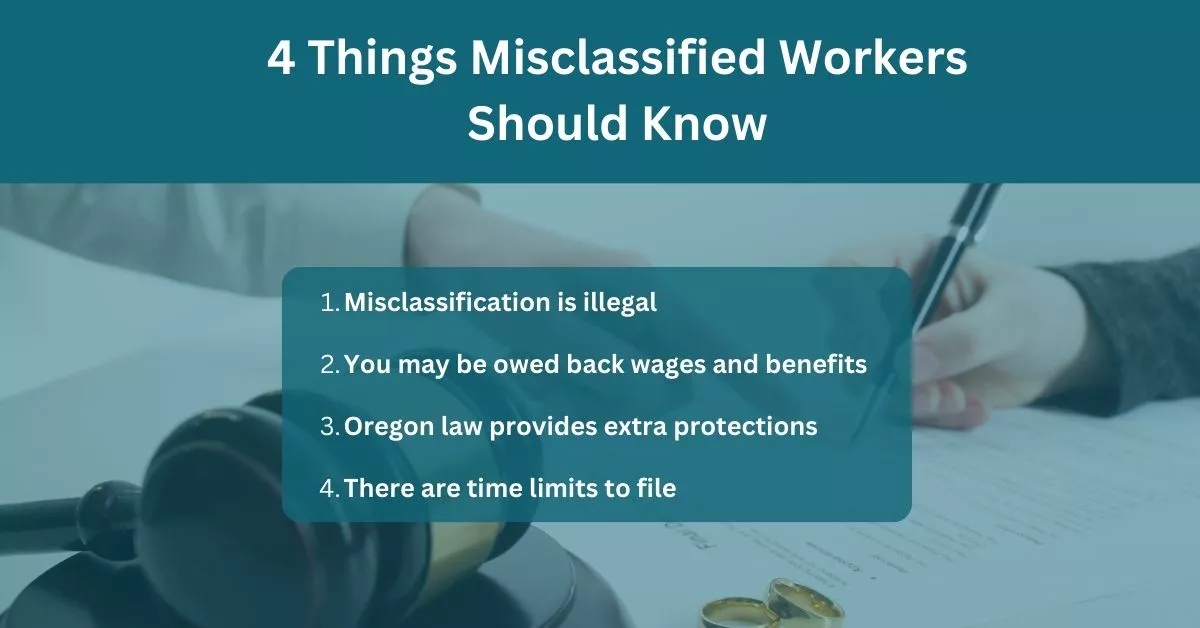

4 Things Misclassified Workers Should Know

- Misclassification is illegal. Under the Fair Labor Standards Act (FLSA), employers must classify workers correctly and provide minimum wage and overtime protections. Misclassifying employees as independent contractors violates federal law and deprives workers of pay and benefits.

- You may be owed back wages and benefits. Misclassified workers can sue for unpaid overtime, minimum wages, reimbursement of expenses, health insurance, paid leave and retirement contributions. Penalties and interest are also available.

- Oregon law provides extra protections. Oregon’s independent contractor statute (ORS 670.600) uses a multi‑factor test. If the hiring entity controls your work or you lack a separate business, you’re likely an employee entitled to wage protections and benefits.

- There are time limits to file. You must file administrative complaints or lawsuits within certain deadlines; some claims must be filed within one year. Talking to an employment lawyer right away preserves your rights.

How Meyer Employment Law Can Help

As an employee‑only law firm, Meyer Employment Law has extensive experience representing workers misclassified as independent contractors. We help clients evaluate whether they have been misclassified, gather evidence, file administrative complaints and bring lawsuits for back wages and benefits. Our attorneys handle cases involving wage theft, overtime violations, wrongful termination and retaliation.

If you’re unsure whether you’ve been properly classified, contact us for a confidential consultation. We will review your work arrangement, explain your rights and help you take the next steps to secure the compensation you deserve.

Conclusion

Misclassification deprives workers of basic protections and benefits. If you have been labeled an independent contractor but are treated like an employee, you may be owed significant compensation.

Both federal and Oregon law provide avenues for misclassified workers to sue for unpaid wages, benefits and penalties. Acting quickly is important because there are strict time limits for filing complaints and lawsuits. Don’t hesitate to seek legal advice: standing up for your rights helps protect you and ensures that employers follow the law.

FAQs

What’s the difference between an employee and an independent contractor? Employees work under the direction and control of the employer and are entitled to wage and hour protections. Independent contractors run their own businesses, control how they perform work, and are responsible for paying their own taxes and benefits. Oregon’s multi‑factor test in ORS 670.600 determines status.

Can I sue my employer for misclassifying me as an independent contractor? Yes. Misclassified workers can file complaints with BOLI or the DOL and bring civil lawsuits seeking unpaid wages, overtime, benefits, penalties and attorneys’ fees. If multiple workers are misclassified, class actions may be appropriate.

What benefits can I recover through a misclassification lawsuit? You can recover unpaid minimum wage, overtime pay, reimbursement of business expenses, retroactive benefits (such as health insurance or paid leave), statutory penalties, interest and attorneys’ fees.

Is there a time limit to file a misclassification claim? Yes. Some wage claims must be filed within one year, while federal claims under the FLSA have a two‑year statute of limitations (three years for willful violations). Other claims may have different deadlines, so consult an attorney promptly.

What should I do if I think I’m misclassified? Review your work arrangement, document your hours and tasks, and consult an employment lawyer. You can also file a complaint with BOLI or the DOL’s Wage and Hour Division.